FINANCIAL RESOURCES

Get financial resources to help you in your profession and life

Jump to: OPA Fee Guideline | Fee Guideline FAQs | Compensation Reports |Financial Services Webinars

In the fall of 2023, OPA released a survey examining market fees for private practices in Ontario with a goal of identifying common fees and rates for physiotherapist services in the private sector.

OPA engaged with a working group of physiotherapists who represent diverse geographical regions, practice models, and practice sizes across Ontario, as well as a professional consultant, utilizing the data from the market fee survey to develop a Usual and Customary Fee Guideline for physiotherapists, patients, and third-party payers.

We are pleased to release the 2024 Fee Guideline, which is a significant step in providing guidance on fair and reasonable billing for physiotherapists. This Fee Guideline will be foundational in supporting OPA’s advocacy for fair compensation, and can guide funders to higher levels of coverage and reimbursement that align with market rates across Ontario.

FREQUENTLY ASKED QUESTIONS – 2024 FEE GUIDELINE

Fee guidelines are used to support physiotherapists in setting market-rate fees for their practice, as well as advocating for market-rate levels of reimbursement from third-party payors. The goal of this fee guideline is ultimately to provide guidance on fair and reasonable billing practices.

The OPA last published a fee guideline in 2002 which was based on a market fee data at the time, and that document is still referenced despite not being current. Data that informs the 2024 Fee Guideline begins to highlight and address the challenges faced by the profession when physiotherapy fees have not kept pace with inflation or practice changes.

The OPA intends to use this Fee Guideline to advocate for fair compensation when consulting funders and payors of physiotherapy services, including the Government of Ontario, WSIB, Auto Insurance Providers, and private health insurance providers. Since this Fee Guideline (and future updated versions of the Fee Guideline) are based on reported fees by physiotherapists, it can be used as a tool to guide funders to higher levels of coverage and reimbursement that better align with market rates.

The OPA commits to updating the fee guideline annually according to the Ontario Healthcare Component of the Consumer Price Index. Additionally, the OPA will use methods to improve the comprehensiveness of reporting and work toward the identification of usual and customary fee recommendations that account for physiotherapy expertise, scope of practice implementation, and inflation.

This tool can be used as a guide to help you determine appropriate market fees, though the ranges in this guide are not binding and should not be considered as minimums and maximums. This document can be used as an education tool for the public who receives physiotherapy services, and as a reference point for third party payers when setting fees.

In using this document, ensure that all areas of your practice, including Fees, Billings, and Accounts are in accordance with the practice Standards set by the College of Physiotherapists of Ontario.

The fees have been established by conducting a market fee survey of registered physiotherapists working in private practice within Ontario (both clinic and private home care services), followed by consultation with both a government and economics specialist and a working group of physiotherapists across Ontario who represent diverse private practice models, sizes, and geographic regions, and review and approval by the OPA’s Board of Directors.

The specific ranges outlined in the fee guideline span the 85th-90th percentiles of reported fees from 965 physiotherapists in the OPA’s market fee survey, which was conducted between November and December 2023, and align with factors in the reported usual and customary fees for assessment, treatment, in-person, and virtual services. The 85th percentile was chosen because it has been established as a reasonable fee for physiotherapy services based on past decisions in Ontario case law.

The fee guideline recommends billing 50-100% of the physiotherapy rate, charged in 10-minute increments, and alternatively, aligning with the Government of Canada’s vehicle rate of $0.59 per kilometre. The 50-100% range was intentionally kept broad to enable flexibility in practices and account for differences in travel requirements across Ontario.

For example, in regions where travel limits the number of services provided in a given workday, higher travel fees may apply to account for lost revenue from lower volume. In contrast, some areas may have short travel times and may be billed at a lower rate to account for higher volume caseloads.

Yes. This fee guideline reflects services commonly provided at rates most often reported by physiotherapists, though it does not include every type of service or level of expertise, nor does it specifically address practice models or local market demands. The recommended fees are neither exhaustive nor binding on physiotherapists. Where appropriate and necessary, your fees may vary from the Guideline.

The Fee Guideline outlines general types of services, rather than specific patient populations or types of conditions, such as assessment and treatment planning, report writing, case management, collaborative care, etc.

Services that are not listed may include but are not limited to court appearances or attendance at physician or other healthcare appointments as requested/needed. It is recommended that any and all services provided by a physiotherapist are calculated using the 10-minute rate range as a baseline, and then adjusting fees based on the education, resources.

No. This fee guideline only applies to physiotherapy treatments provided by registered physiotherapists. Kinesiologists, chiropractors, and potentially other healthcare professionals may offer physiotherapy services, as ‘physiotherapy’ is not a protected term. This Fee Guideline does not apply in these cases.

Yes. Supervision is within the scope of practice of physiotherapists, and services provided by assistants are doing so under the delegation of a physiotherapist. As such, it is considered billable physiotherapist time. Physiotherapists must adhere to the Supervision Standard set by the College of Physiotherapists of Ontario.

According to the College of Physiotherapists of Ontario, there is currently no specified maximum number of physiotherapist assistants that can be supervised at once.

Given that this Fee Guideline does not account for physiotherapist assistant services, the recommended fees are not intended to be calculated based on the number of assistants present.

In the future, the OPA will engage in consultation with the profession to identify how services provided by physiotherapist assistants or other unregulated professionals under a physiotherapist’s supervision can be optimally accounted for in subsequent versions of the fee guideline.

It’s great that you are thinking of getting involved! The fee guideline is what we call a ‘living document’, meaning that while it is published and available for use, it will continue to be revised in the future based on updated market data and inflation, and the OPA encourages involvement from members. OPA engages in consultation processes when developing documents such as this fee guideline, which involves ensuring diversity and representation of the profession in Ontario. As such, we cannot guarantee that every person who puts their name forward will be selected as part of a working group or review committee, though we encourage you to send us your ideas and feedback or respond to open calls for consultation when available.

For other opportunities to get involved with OPA, please see our website for more information, or email physiomail@opa.on.ca.

Questions related to the fee guideline, or the FAQs can be directed to Aleksandra Nikolovski, PT, Project Manager, Practice and Policy at anikolovski@opa.on.ca. Note: This is a living document, and the FAQs will be updated on an ongoing basis.

Yes. This document is publicly available and can be shared with your clinical team, members of other professions (both regulated and unregulated), patients, insurance providers, and other third-party payors.

Ontario Physiotherapy Association. Physiotherapy Usual and Customary Fee Guideline: 2024. Ontario Physiotherapy Association, October 9, 2024. https://opa.on.ca/wp-content/uploads/2024/10/OPA-Fee-Guideline-2024.pdf.

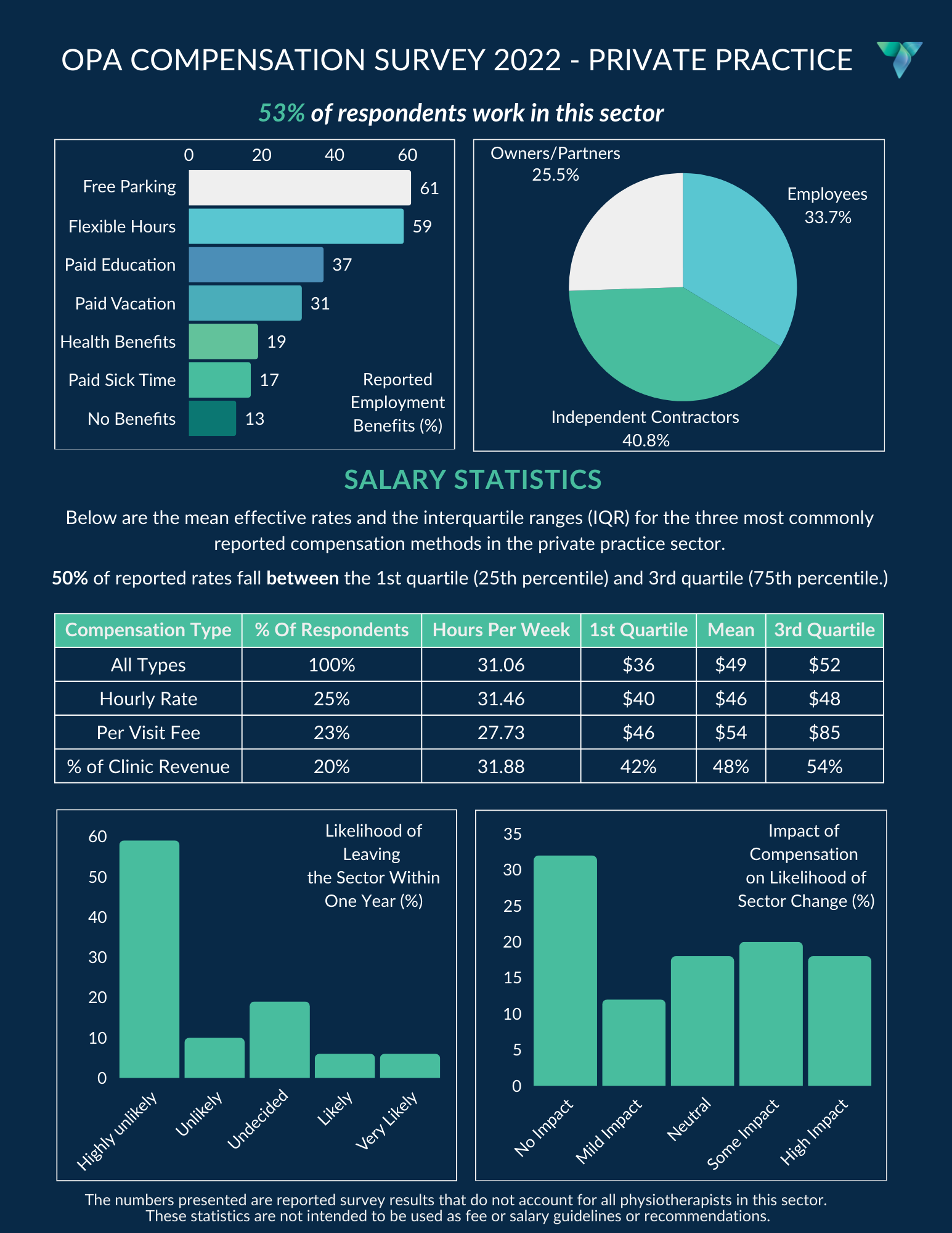

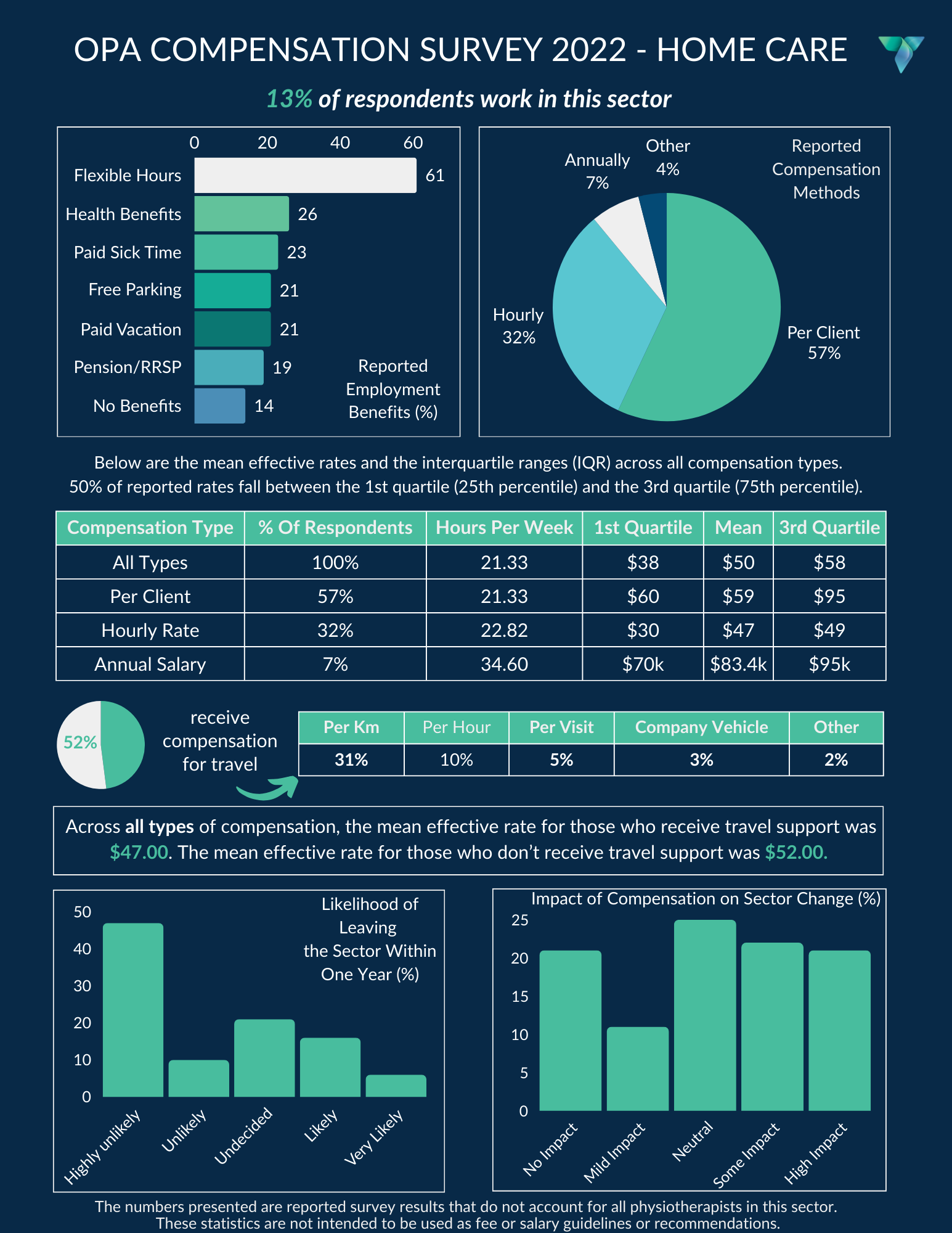

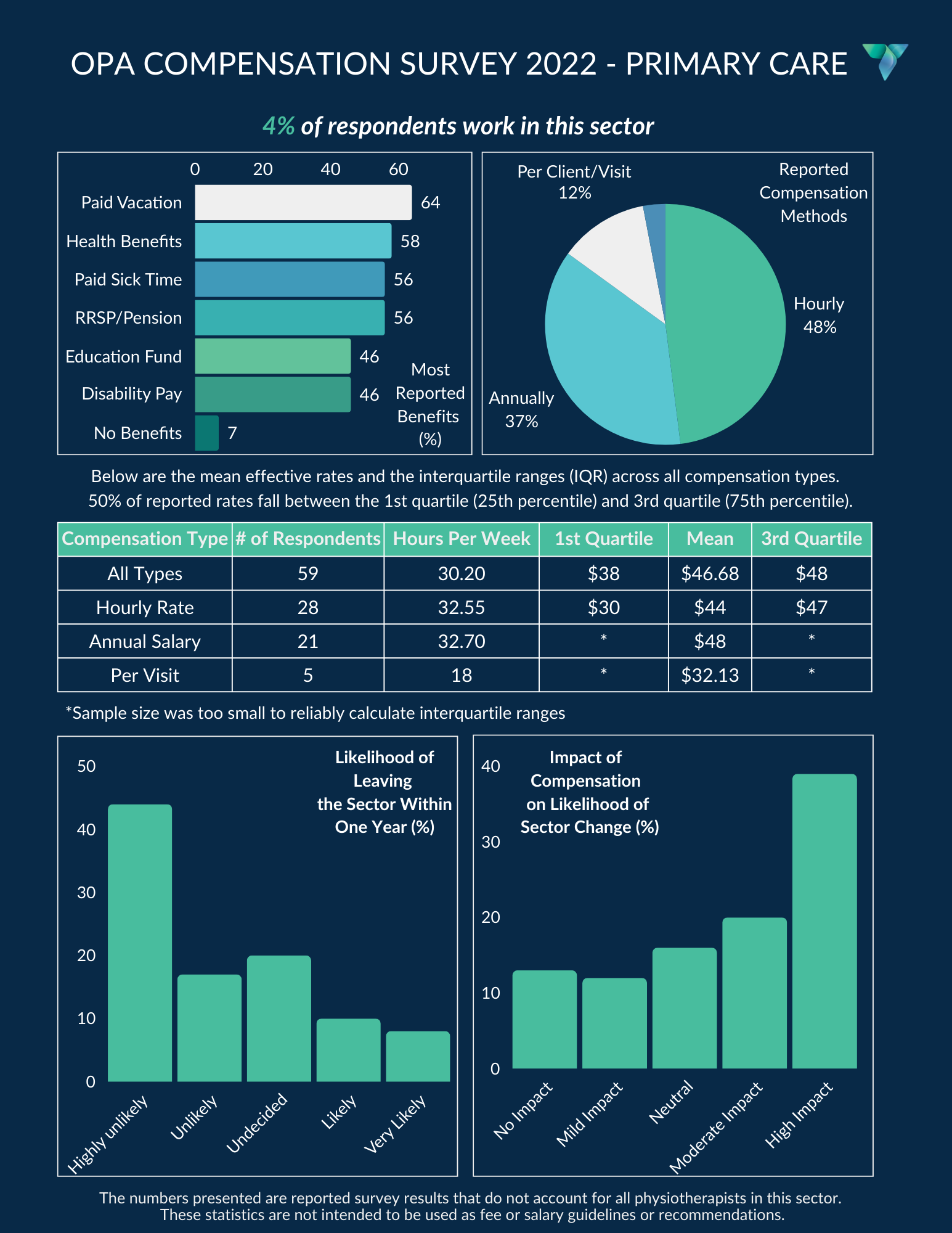

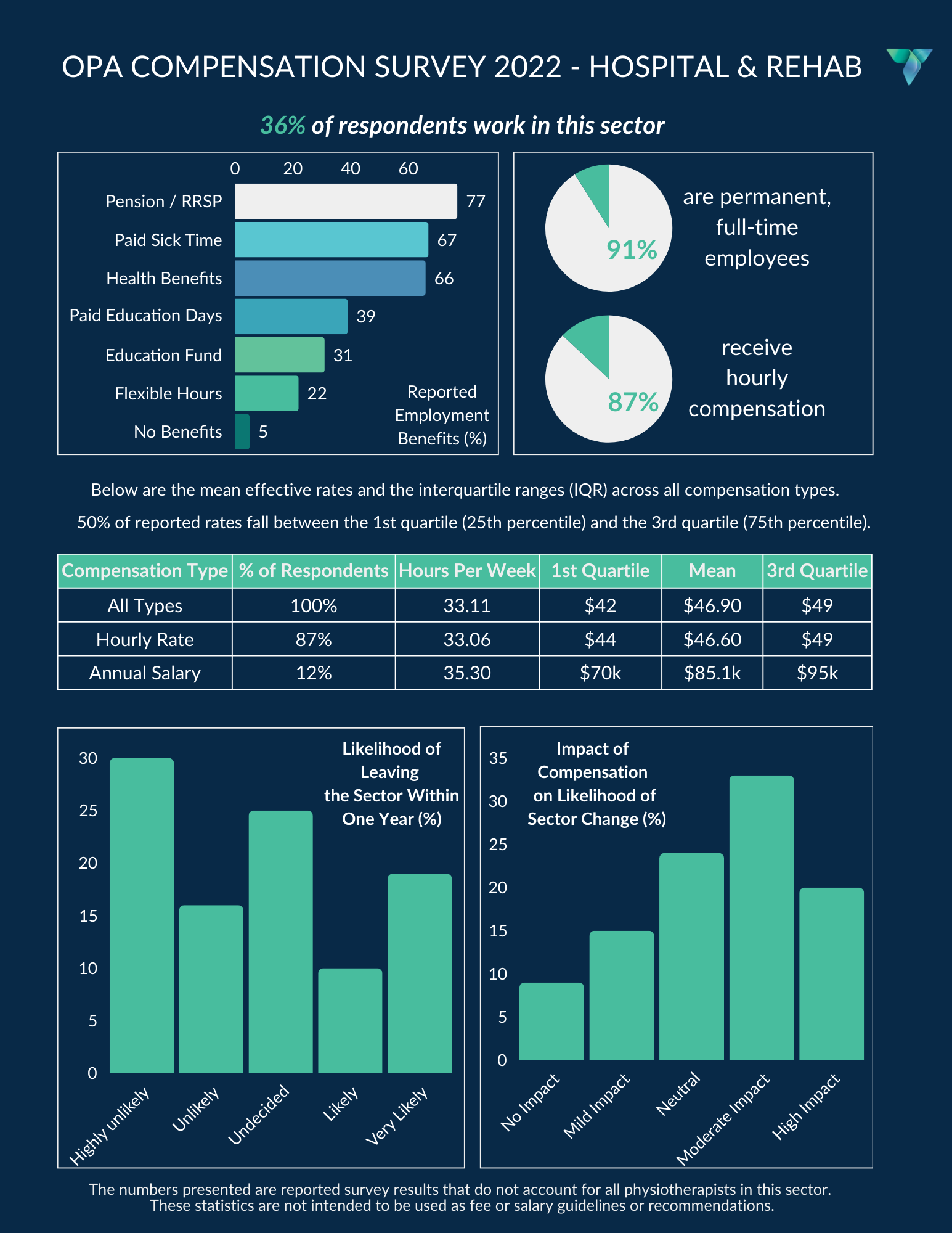

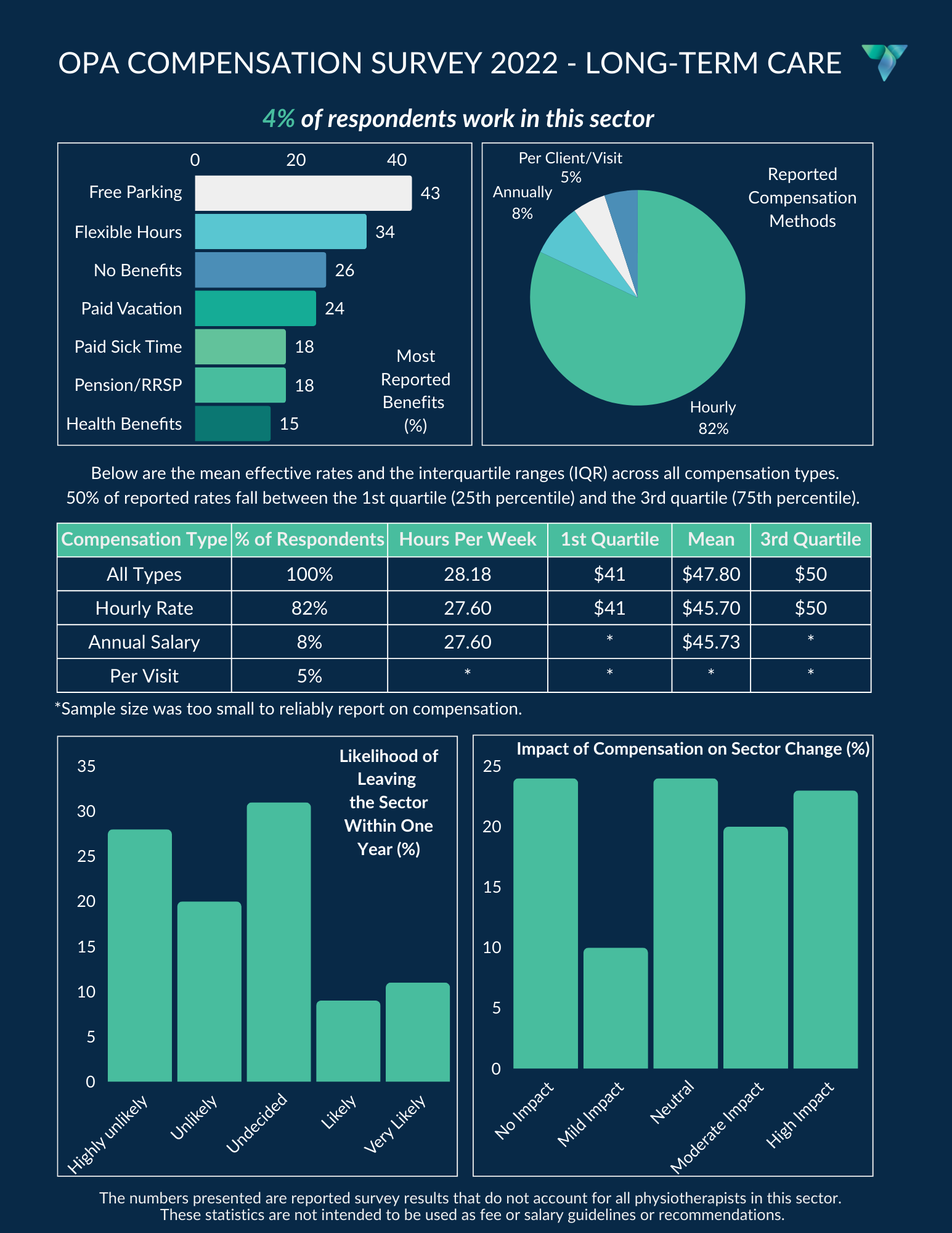

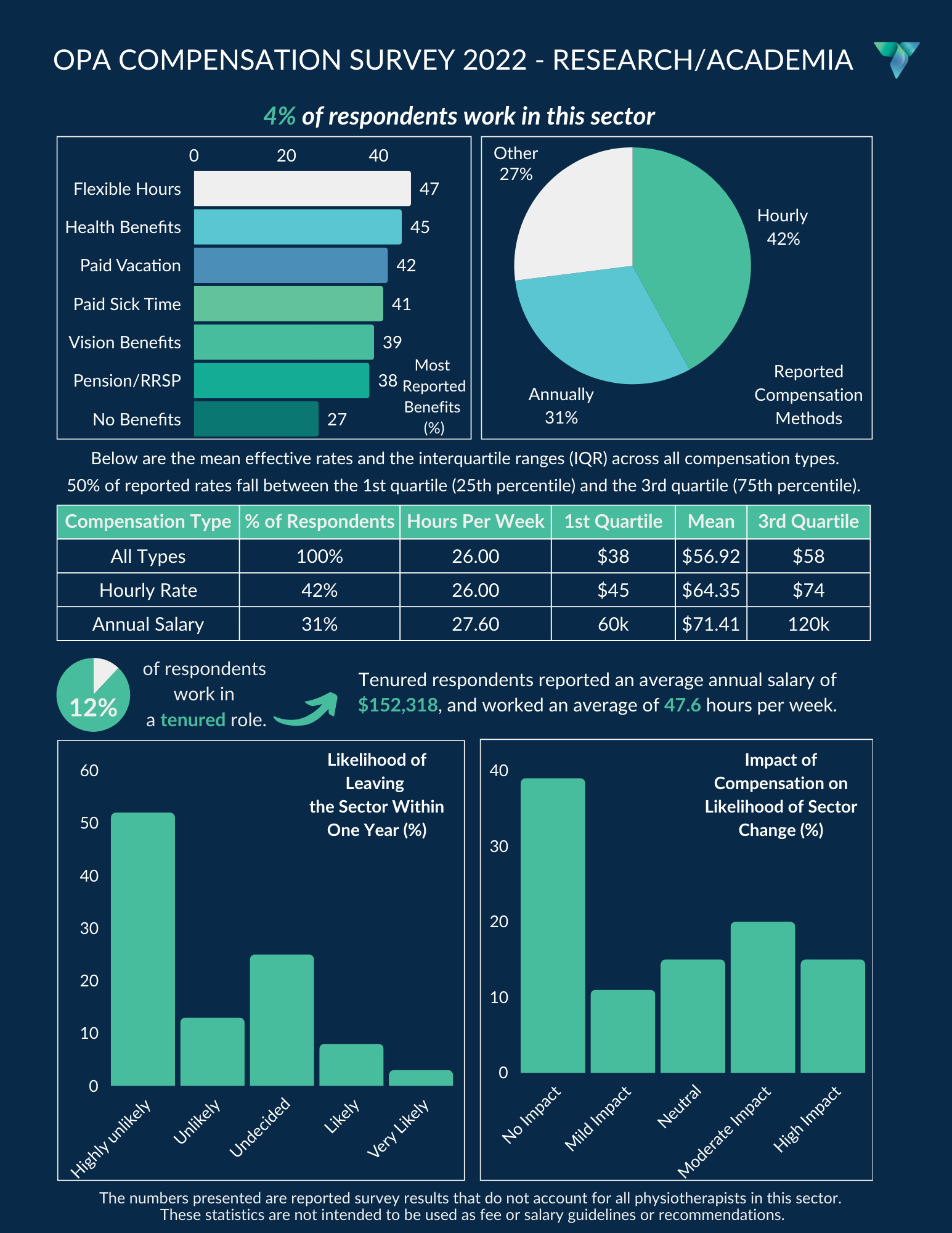

OPA, in collaboration with itracks, conducted a compensation survey that was distributed to physiotherapists across Ontario in late 2022. The goal of this survey was to collect data about compensation and benefits within various sectors and examine factors impacting career decisions and job satisfaction.

OPA is pleased to present the results of this survey, which are published in the form of a general report of methods and demographics, a cross-sector analysis report, and sector-specific reports for private practice, hospital and rehab, long-term care, research and academia, home care, and primary care. The general report and sector reports are accompanied by short visual graphics that summarize key data points and themes.

Intended Use of The Reports:

These reports are not a tool to determine appropriate compensation levels for physiotherapists in specific workplaces. Rather, these reports reflect compensation for PTs in winter 2022-2023. The reports and graphics give context and understanding of the landscape to assist those working on their own compensation goals.

The Government of Ontario passed Bill 149 in 2024 which requires salary band publication in job postings which will lead to increased pay transparency. By sharing these compensation reports, OPA can support physiotherapists in making their own judgments about published rates of pay. Finally, this report provides insights to increase OPA’s understanding of workforce and health human resource issues and will inform discussion with other partners in the healthcare sector.

REASONS FOR THE DELAY

The delay in releasing these reports was caused by significant numbers of automated responses. An extensive review was undertaken along with repeated analyses and verification of the data through consultation with a specialist, and the use of additional analysis tools, to ensure results are not skewed by inclusion of fake or fraudulent data.

Speaker: Brian E. Shumak, B.Sc., CLU, CFP, CHS, CEA, EPC, CFDS, TEP

After graduating with a Bachelor of Science from the University of Toronto in 1990, he moved into the Insurance Business to continue a fifty-year family history. Since his initial foray into the insurance world, Brian has excelled in the corporate and personal arenas of Financial Planning, Employee Benefits, Wealth Management and Estate Planning.

After completing the university level Chartered Life Underwriter (CLU) curriculum in 1998 and obtaining his designation, Brian ventured abroad to work in one of the world’s financial capitals in Zurich, Switzerland.

Upon his return, he resumed an active role in the Financial Planning World, obtaining his Certified Financial Planner (CFP) designation in 2003, the Trust and Estate Planning (TEP) designation in 2004, the Chartered Financial Divorce Specialist (CFDS) designation in 2016, his Certified Health Insurance Specialist (CHS), Elder Planning Counselor (EPC) designations in 2017 and his Certified Executor Advisor (CEA) in 2022. He also served on the Board of Directors at Advocis in 2004 and 2005 as the Director of Mentoring where he redesigned the program from top to bottom. In addition, he continued to build his successful practice.

WEBINAR #1: CASH FLOW MANAGEMENT

This webinar will discuss the optimal way to manage your cash flow whether you are an employee or an independent contractor. It will discuss how to set your banking up and how to spend within your means.

WEBINAR #2: BUSINESS STRUCTURES

This webinar will discuss the types of ways you can work, does incorporation make sense, and the differences in taxation between the structures.

WEBINAR #3: INVESTMENT PLANNING

This webinar will discuss the types of investments, and the pros and cons of each, that you can make (Stocks, Bonds, ETFs, GICs etc.). We will also discuss the types of registrations you can use (RRSPs, TFSAs, FHSAs, Non-Registered Plans) and their pros and cons.

WEBINAR #4: INSURANCE PLANNING

This webinar will discuss the different types of insurance that exist and the reasons why or why you shouldn’t have them. We will discuss the differences between individual insurance and group (employee plans) so you can ensure you have the right type of plans in place now and in the future.